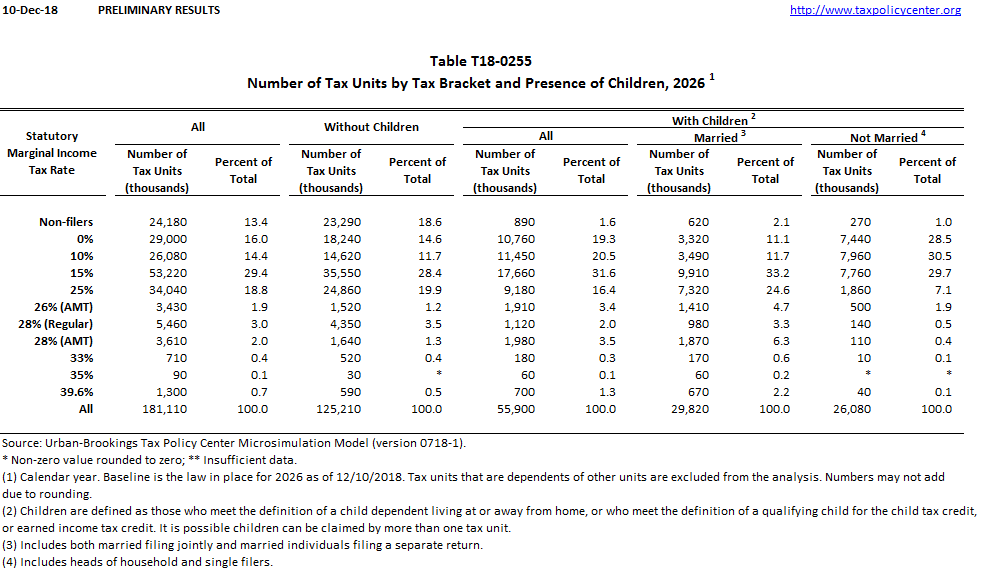

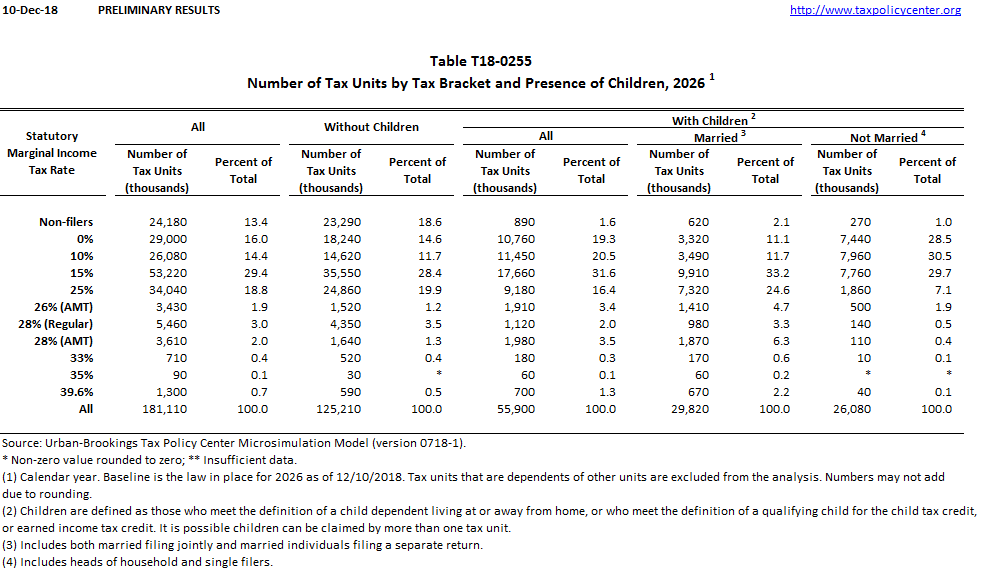

Estimated Federal Tax Brackets 2026

With great pleasure, we will explore the intriguing topic related to Estimated Federal Tax Brackets 2026. Let’s weave interesting information and offer fresh perspectives to the readers.

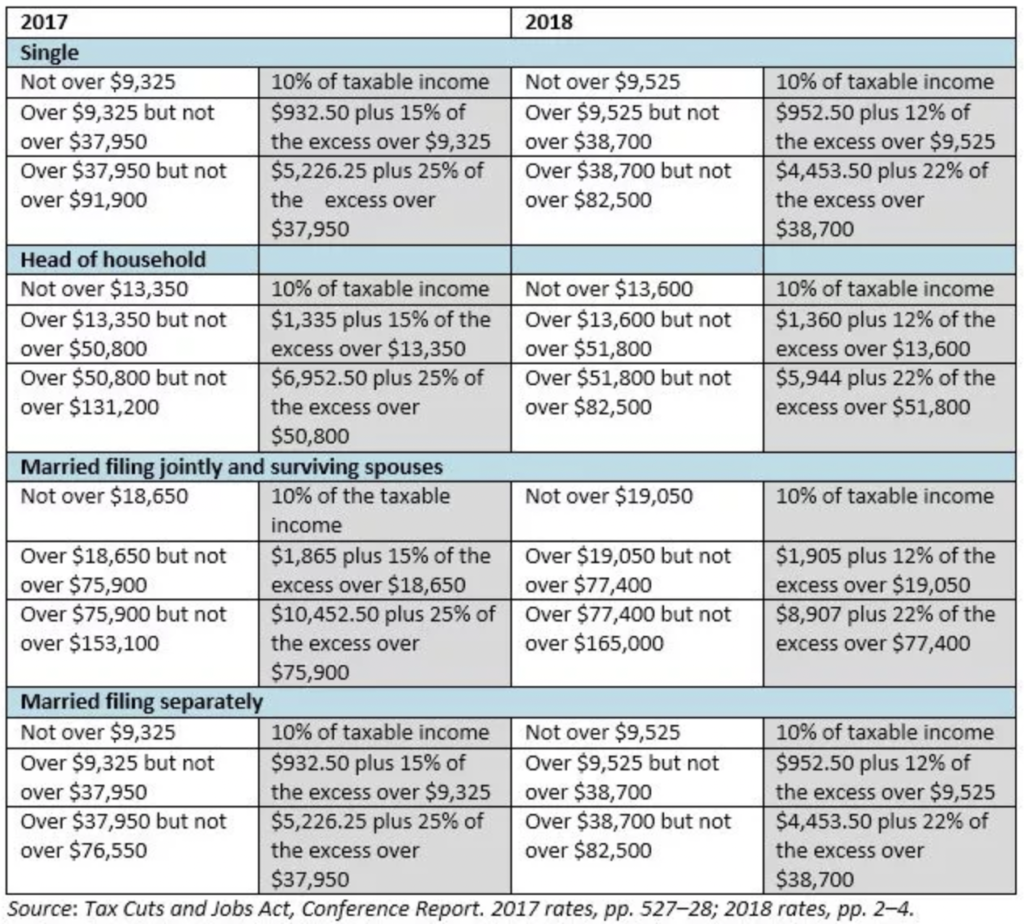

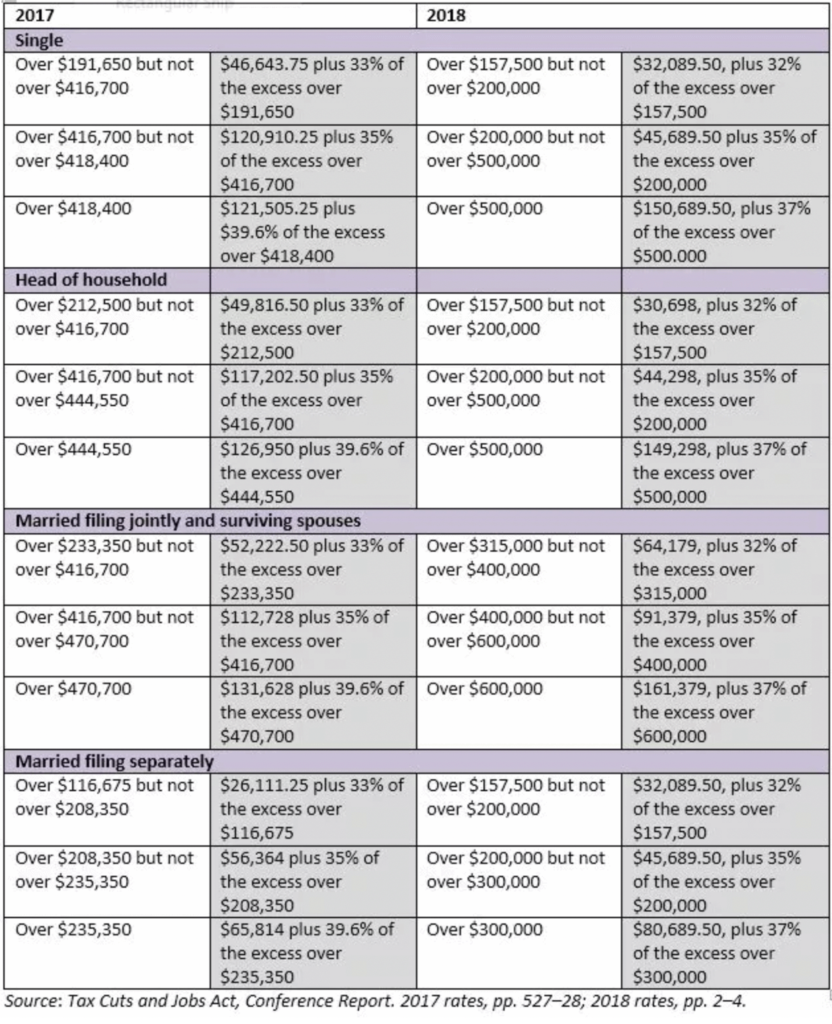

The Internal Revenue Service (IRS) adjusts the federal income tax brackets annually to account for inflation. The 2026 federal income tax brackets are estimated based on the projected inflation rate.

The standard deduction is a specific amount that you can deduct from your taxable income before you calculate your taxes. The standard deduction for 2026 is estimated to be:

The personal exemption is a specific amount that you can deduct from your taxable income for each dependent you claim. The personal exemption for 2026 is estimated to be $4,400.

If you expect to owe more than $1,000 in taxes, you may be required to make estimated tax payments. Estimated tax payments are quarterly payments that you make to the IRS to prepay your taxes. The due dates for estimated tax payments are April 15, June 15, September 15, and January 15 of the following year.

Tax credits are dollar-for-dollar reductions in your tax liability. Some of the most common tax credits include:

Your employer will withhold taxes from your paycheck based on the information you provide on your Form W-4. If you do not have enough taxes withheld, you may have to make estimated tax payments or pay additional taxes when you file your tax return.

If you overpaid your taxes, you will receive a tax refund. The IRS will issue tax refunds within 21 days of receiving your tax return.

The estimated federal tax brackets for 2026 are subject to change. The actual tax brackets will be announced by the IRS in late 2025.

Thus, we hope this article has provided valuable insights into Estimated Federal Tax Brackets 2026. We appreciate your attention to our article. See you in our next article!